Ukraine crisis briefing

Powered by

Download GlobalData’s Ukraine Crisis Executive Briefing report

- ECONOMIC IMPACT -

Latest update: 16 November

Since Russia launched a full-scale military invasion of Ukraine on 24 February, data from the United Nations Refugee Agency indicates that 7.8 million refugees from Ukraine have been recorded across Europe.

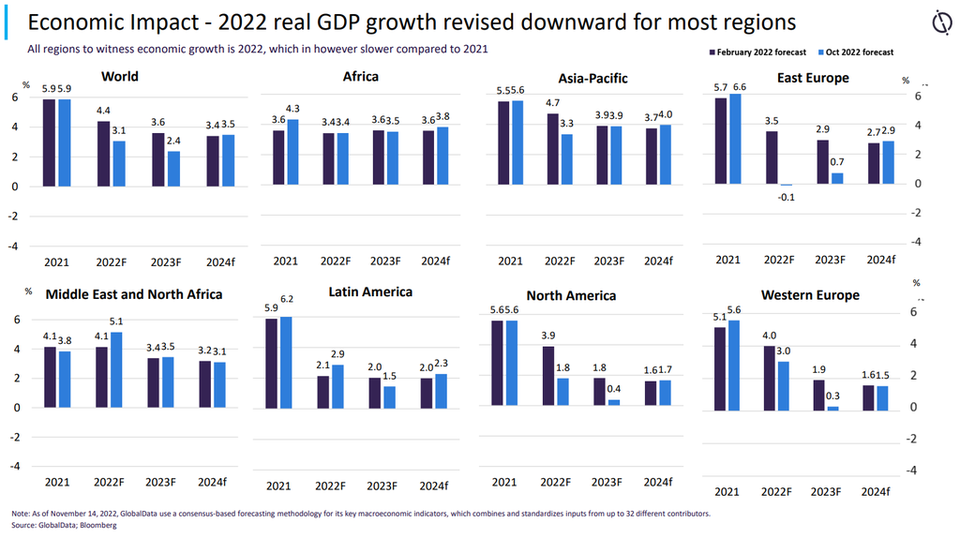

GlobalData forecasts that the world economy will grow at a slower pace of 3.1% in 2022, following a 5.9% growth in 2021. Global inflation is projected to rise to 8.4% in 2022 from 3.5% in the previous year due to supply chain disruption.

- SECTOR IMPACT: TRAVEL AND TOURISM -

Latest update: 16 November

Revenue impact

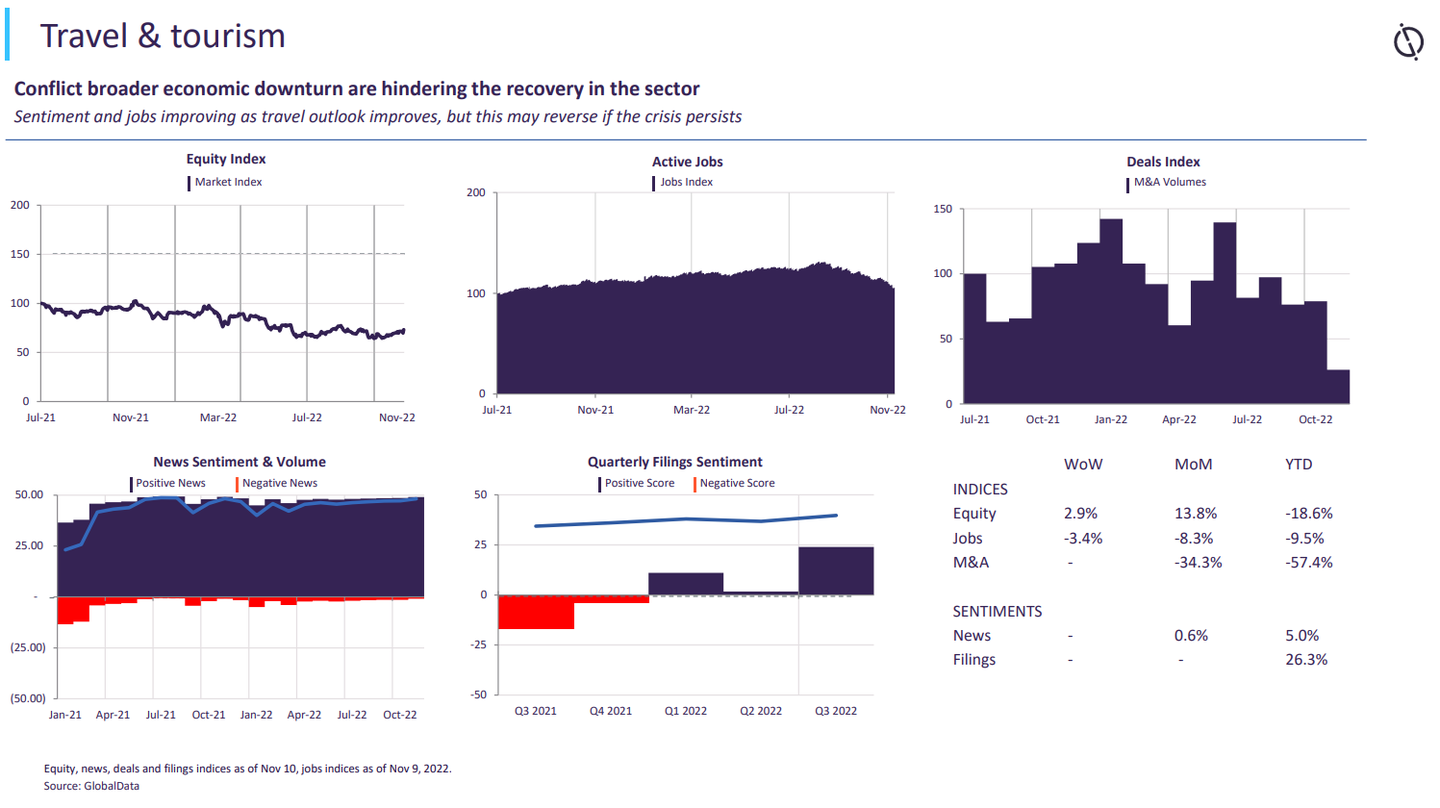

With no end to the conflict in sight, fuel prices will continue to surge for airlines.

This will negatively impact their bottom lines unless they pass the entire additional cost on to the traveller, which could reduce demand in an industry where consumers can easily find substitute services.

For example, US Passenger Airlines' fuel cost per available seat mile increased from $0.31 to $0.47, a year-on-year increase of 51.6%. American Airlines is forecasting fuel to increase by $3.92 to $3.97 per gallon, increasing $0.33 per gallon from the previous estimate of $3.59 to $3.64.

Increasing fuel costs means that airlines cannot optimise performance and their post-Covid-19 recovery will be extended. The conflict has also raised concerns surrounding potential titanium supply shortages, with titanium a key metal used in the manufacturing of aircraft.

Ukraine and Russia are among the leading producers of titanium, and the ongoing conflict could impact supply in the near term causing a knock-on effect on airlines.

Travel enters a new era

Low tourist demand means many cars rental companies have been forced to sell their fleets in order to stay afloat during the Covid-19 pandemic.

Markets in which airport pickup is the largest channel, such as the US, have particularly suffered, but the effect has been felt all over the world.

But as demand picks up, with more people traveling and supply still down, major price hikes are likely to be in store for anyone who wants to rent a car.

Key Travel And Tourism developments

SANCTIONS

Under mounting pressure from Western sanctions, Aeroflot, Rossiya Airlines, Ural Airlines, and Russian Railways have seen their revenue cut dramatically. Aeroflot, Russia's flagship airline, is now planning to raise up to $3bn in an emergency share issue. Passenger numbers for Aeroflot are down 8.2% YoY in the first nine months of 2022.

Thailand has fully reopened its borders to international tourists with no need for a negative pre-departure PCR test. Additionally, it has not placed any restrictions on Russia and has a tourism product that is naturally attractive to Russian travellers.

These factors will likely combine to create a stiff year-on-year increase in Russian travel to Thailand in 2022. Thailand’s Minister of Commerce stated that Thai banks had displayed interest in Russia’s proposal to introduce the MIR payment system for Russian travellers in Thailand and pledged to coordinate with the appropriate ministries to facilitate direct flights from Russia

Travel enters a new era

Low tourist demand means many cars rental companies have been forced to sell their fleets in order to stay afloat during the Covid-19 pandemic.

Markets in which airport pickup is the largest channel, such as the US, have particularly suffered, but the effect has been felt all over the world.

But as demand picks up, with more people traveling and supply still down, major price hikes are likely to be in store for anyone who wants to rent a car.