All Images: Virgin Hyperloop

Operations

ROSCOs and repatriated profits

Alejandro Gonzalez takes a look at rolling stock ownership, leasing, and profits in the UK.

The vast majority of the trains in service in England, Scotland and Wales are not owned by the companies that operate passenger services but by private companies called rolling stock companies (ROSCOs), who lease the engines and carriages to train operating companies (TOCs) who control franchises issued by government. (In Northern Ireland, trains are owned by the state railway, NI Railways)

Virgin Hyperloop chief technology officer and co-founder Josh Giegel and director of passenger experience Sara Luchian

MaxBögl product manager Andreas Rau. Image: Max Bögl

Privatisation

This ROSCO-leasing arrangement is the brainchild of John Major’s Conservative Government which embarked on a plan to privatise British Rail (BR) over 30 years ago. Under the Tories, British Rail (BR) was split into three distinct parts.

- Rail infrastructure (tracks and signalling) was sold off to Railtrack, a consortium that later became Network Rail.

- The customer-facing passenger transport provision was tendered out via a franchise system to TOCs, private companies in control of various regions backed by a public subsidy in return for company investment to improve the service.

- Lastly, BR’s fleet of railway vehicles was sold to three ROSCOs, private companies that would manage and lease stock to the new franchisees. On privatisation, ROSCOs were set up to offer operating leases rather than finance leases, which meant assets were returned to the ROSCO at the end of the lease period. It also meant they carried most of the risk of holding and maintaining the rolling stock. The ROSCOs were also responsible for investing in new trains.

Birth of ROSCOs

As a result of the Railways Act 1993, three rolling stock companies – Angel Trains, Eversholt and Porterbrook – came into being and took control, in equal measure, of BR’s passenger fleet of about 11,000 vehicles at the time, including new and old assets.

In 1993, the BR passenger fleet had an approximate book value of £2bn ($2.4bn), according to a June 2017 House of Commons briefing paper. The proceeds from the sale of the ROSCOs exceeded £2.5bn ($2.9bn), the government said at the time.

Two subsequent reports, looking into the privatisation of the ROSCOs, the first by the National Audit Office (NAO) and the second by the Commons Public Accounts Committee, both in 1998, concluded that the ROSCO sale had been rushed through, causing a material loss of value for the taxpayer.

“The NAO calculated that at the time of privatisation the value of the three ROSCOs future cash flows, under continuing public ownership, would have been £2.9bn ($3.5bn). The value obtained by the government sale was considered to be only ‘up to £2.2bn ($2.6bn),” according to the House of Commons briefing paper.

All three ROSCOs experienced a wave of buying and selling in the years after privatisation. Angel Trains, which was originally bought for almost £700m in 1996 was sold for £3.5bn ($4.2bn) in 2015. Eversholt, which was acquired in 1996 for £518m ($616.4m), was sold in 2015 for £2.5bn ($2.9bn). Porterbrook, acquired for £528m ($628.3m) in 1996, was sold for an undisclosed sum in 2014.

In 2006, the Labour government ordered a Competition Commission inquiry into the ROSCOs’ practices and suggestions they were overcharging TOCs, claims that were rejected by the ROSCOs. In its findings, the CC found a lack of rivalry resulting from a shortage of vehicles available for lease.

Mini-ROSCOs

In recent years, other specialist train leasing companies, mini-ROSCOs, have come along to begin to rival the top players, these are:

- Beacon Rail

- Caledonian Rail Leasing

- GE

- Halifax Asset Finance

- Rock Rail

- Akiem Group (bought Macquarie European Rail)

- Lombard North Central

Nevertheless, the top three ROSCOs continue to own about 87% of the existing rail network fleet, according to the Rail Delivery Group in 2018. According to transport experts, the ROSCOs continue to control no less than 70% of the existing stock.

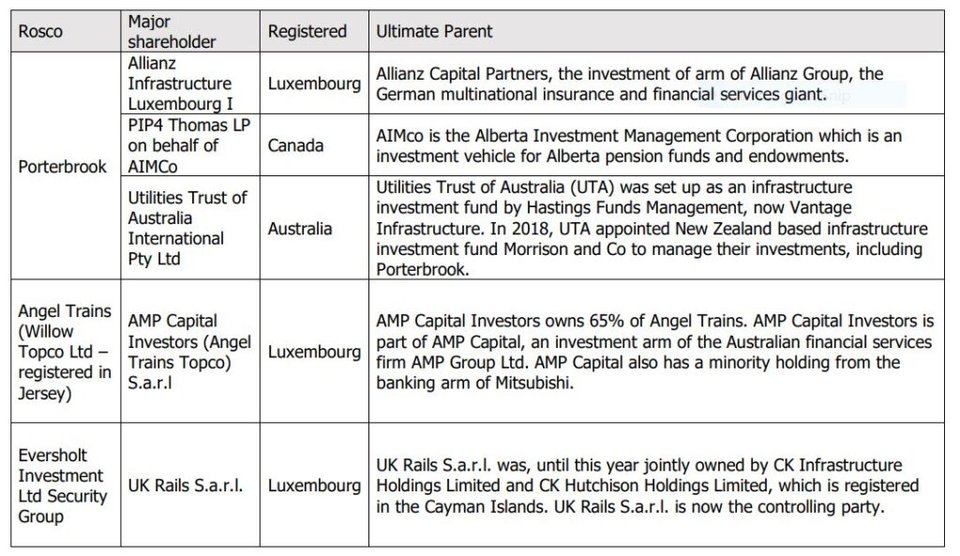

A period of ownership stability followed the buying frenzy of the early years. More recently, on the issue of ownership, an October 2021 briefing by the Rail, Maritime and Transport (RMT) workers’ union, found that all three ROSCOs today have parent companies based in low tax jurisdictions.

ROSCOS and the pandemic

With the government stepping in to guarantee lease payments in full to the ROSCOs by the train operators during the pandemic, the subsequent payment of dividends by ROSCOs to their shareholders was tantamount to "government dependency on profit-making" the union said.

During the pandemic, the government propped up the UK railways with £14bn ($16.7bn), after effectively nationalising the privatised operators in 2020 as working from home became the norm.

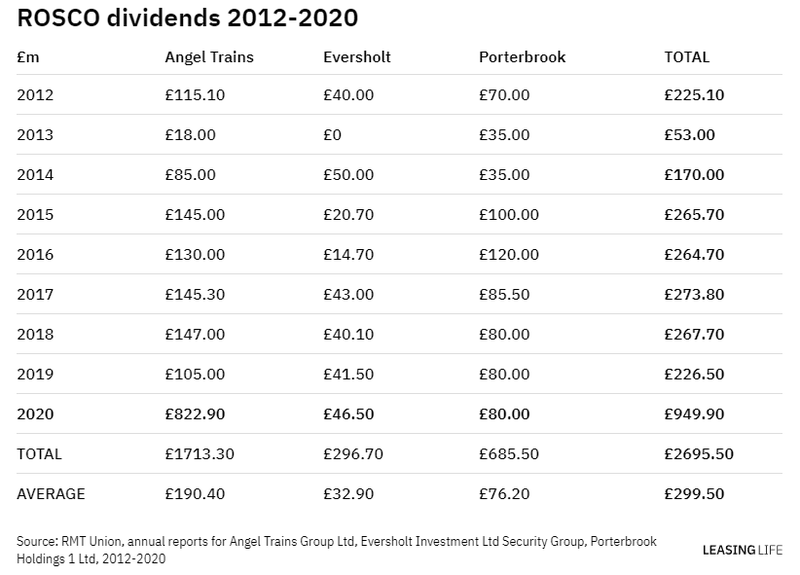

Looking at the 2020 financial year, the three ROSCOs paid out dividends worth £950m ($1.1bn). “The pandemic payouts have mostly disappeared not just overseas but into the murky world of Luxembourg’s low tax regime and the offshore tax haven of Jersey,” the RMT reported.

“The rolling stock racket is a long-established scandal on the railways … in the last 10 years, the rolling stock companies have paid out £2.7bn ($3.2bn) in dividends to their owners. These dividends typically represent around 100% of their pre-tax profits. The average dividend payment is around £260m ($309.4m) each year.

“On average this extraction of profit represents around 13% of what the Train Operating Companies – and now the government – pay to the rolling stock companies. It represents an average of 2.8% of total expenditure by Train Operating companies,” according to the RMT.

The ROSCOs’ overseas parent companies

Today, the ROSCOs are owned by investment vehicles associated with financial service companies and infrastructure investment companies, registered most commonly in Luxembourg.

For travel and tourism industry data, comment and analysis, visit GlobalData's Tourism Intelligence Centre.

This article was originally published on our sister websiteLeasing Life.