Ukraine crisis briefing

Powered by

Download GlobalData’s Ukraine Crisis Executive Briefing report

- ECONOMIC IMPACT -

Latest update: 19 January

Since Russia launched a full-scale military invasion of Ukraine on 24 February, data from the United Nations Refugee Agency indicates that eight million refugees from Ukraine have been recorded across Europe.

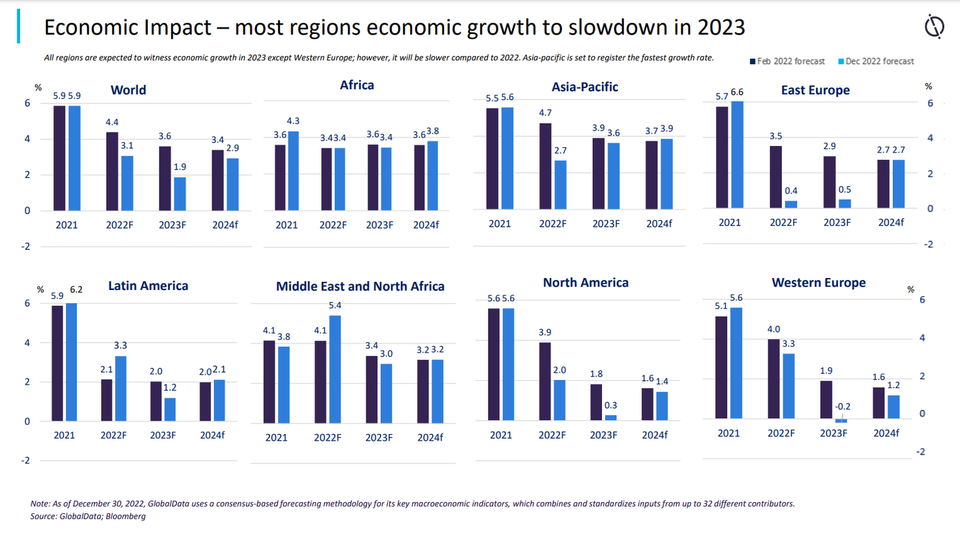

GlobalData forecasts that the world economy will grow at a slower pace of 1.9% in 2023, following a 3.1% growth in 2022. Global inflation is projected to ease to 5% in 2023 from 8.4% in the previous year.

- SECTOR IMPACT: TRAVEL AND TOURISM -

Latest update: 19 January

Revenue impact

Sector analysis from UK-based hotel booking platform hoo states that the Ukraine crisis could cost $10.6bn in lost tourism revenue across Ukraine, Russia, Belarus, and Moldova, with further impacts likely to be felt across neighbouring countries.

The loss of Russian and Ukrainian tourists will prolong the Covid-19 recovery timelines of specific destinations.

According to GlobalData, in 2021, combined outbound tourist expenditure from Russia and Ukraine accounted for 3.5% of total global outbound tourist expenditure.

With the conflict and sanctions impacting both economies, a significantly reduced number of travellers from both countries will be taking trips internationally in 2022, which will contribute to an uneven tourism recovery from the pandemic.

Travel enters a new era

Low tourist demand means many cars rental companies have been forced to sell their fleets in order to stay afloat during the Covid-19 pandemic.

Markets in which airport pickup is the largest channel, such as the US, have particularly suffered, but the effect has been felt all over the world.

But as demand picks up, with more people traveling and supply still down, major price hikes are likely to be in store for anyone who wants to rent a car.

Key Travel And Tourism developments

SANCTIONS

Under mounting pressure from Western sanctions, Aeroflot, Rossiya Airlines, Ural Airlines, and Russian Railways have seen their revenue cut dramatically. Aeroflot, Russia's flagship airline, is now planning to raise up to $3bn in an emergency share issue. Passenger numbers for Aeroflot were down 8.2% YoY in the first nine months of 2022.

Egypt is now looking to capitalise on a lack of outbound options for Russian travellers, created by sanctions. In previous years, tourists from Russia and Ukraine have accounted for up to 40% of beach holidaymakers in Egypt, according to the Ministry of Tourism and the Egyptian Chamber of Tourist Establishments.

According to the Russian tour agency Travelata, Egypt was in the top five tourist destinations for Russian tourists for the Summer of 2022. In October Egypt shelved plans to apply the Russian MIR payment card system in its resorts and hotels amid worries about possible US sanctions.

Travel enters a new era

Low tourist demand means many cars rental companies have been forced to sell their fleets in order to stay afloat during the Covid-19 pandemic.

Markets in which airport pickup is the largest channel, such as the US, have particularly suffered, but the effect has been felt all over the world.

But as demand picks up, with more people traveling and supply still down, major price hikes are likely to be in store for anyone who wants to rent a car.