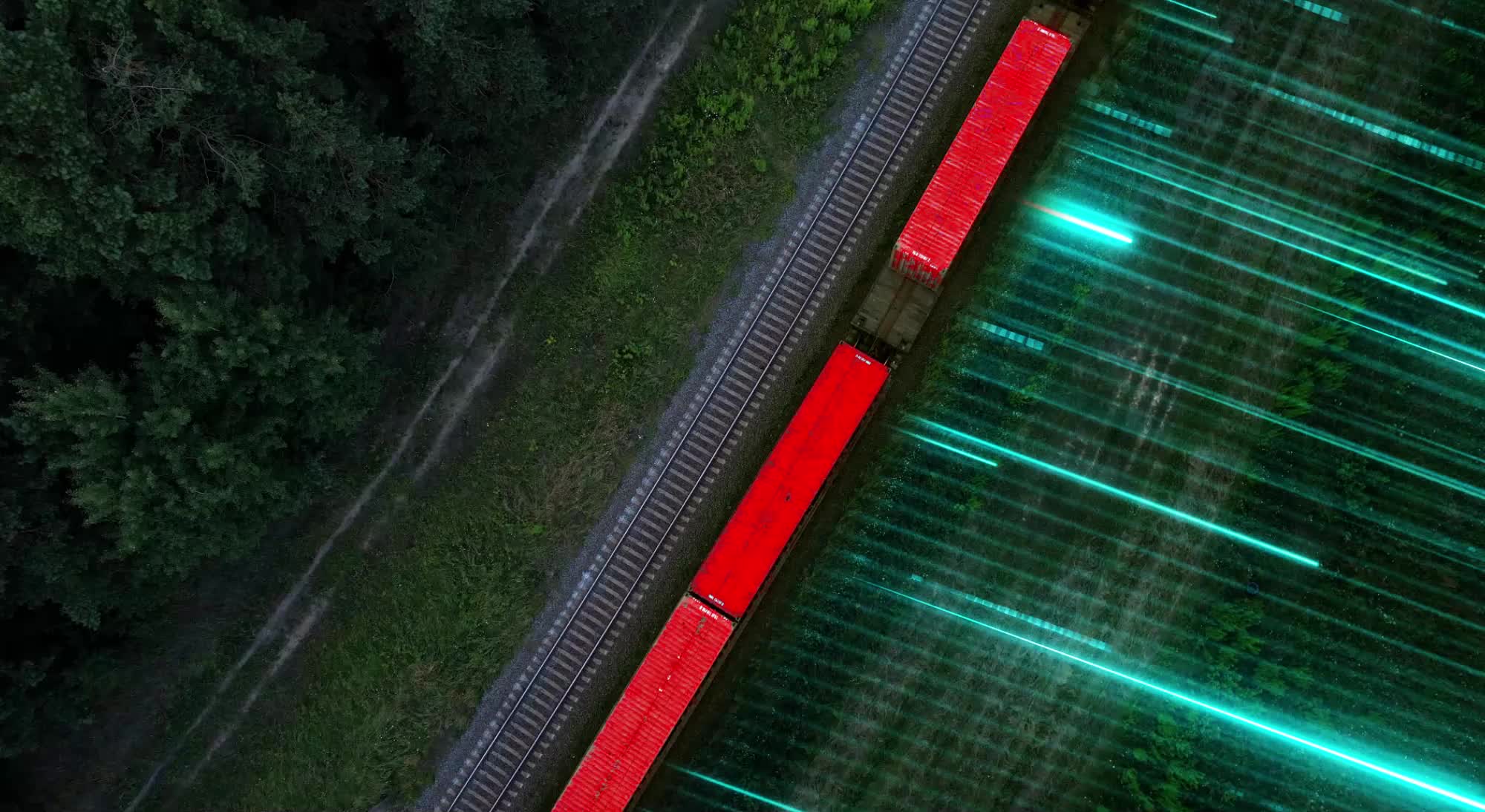

Main video supplied by Sergii Chervov and Maksim Safaniuk/Creatas Video+ / Getty Images Plus via Getty Imagesa

The European freight transport market is predicted to grow by 30% by 2030, which translates to one million additional trucks on European roads. Road transport, however, cannot absorb this growth without an unwelcome increase in social and environmental impacts and a drastic expansion of high-capacity infrastructure.

Credit: ÖBB Weixelbaum

This creates a clear opportunity for freight rail to expand, as shifting goods from road to rail is the most viable way to balance climate ambitions with continued economic and transport growth. To increase the attractiveness and productivity of rail freight, investment is needed in digitalisation and technological modernisation.

The European Rail Traffic Management System (ERTMS), autonomous train operation (ATO), digital capacity management (DCM) and digital automatic coupling (DAC) are all helping to modernise freight operations, creating the foundation for a fully automated and data-driven rail logistics network.

A digital acceleration

“Growing customer demand for integration and transparency, as well as pressure to cut costs and emissions, and the need to compete with road freight,” are the biggest drivers of digitalisation, says Maggie Simpson OBE, Director General, Rail Freight Group (RFG).

“It’s a mix: the market wants efficiency and visibility, while policy is pushing for interoperability and greener logistics.”

Digitalisation, experts agree, is both an operational necessity and a strategic enabler. Better data and automation reduce dwell times and delays, boost asset use and improve reliability, all critical to building customer confidence in rail freight.

“You can’t decarbonise or grow rail’s market share without better data, planning and operational visibility,” Simpson adds, noting that while some believe it’s too complex, too costly or only for larger players in the sector, the reality is that scalable solutions exist for businesses of any size.

Credit: ÖBB Weixelbaum

Case study: ÖBB Rail Cargo Group

ÖBB Rail Cargo Group (ÖBB RCG) has placed digitalisation at the centre of its growth strategy, and aims to replacing analogue, complex and expensive processes with digital, automated solutions that improve costs, transparency and efficiency.

The organisation’s ethos is that digitalisation must enable end-to-end processes and make rail transport, especially multimodality, simple and accessible in order to offer a broader group of customers access to sustainable transport solutions.

“Digitalisation is not only about changing processes, but also the way we work together,” notes ÖBB RCG spokesperson, Julia Krutzler. “All procedures must be rethought, scenarios further developed, things tried out and adapted.

“When developing our digital services, we focus on the needs of our customers and potential users, and have already involved them in the design, development and testing phases. We also rely on an agile way of working with short development intervals, clear goals and guidelines. This enables us to respond more flexibly and quickly to trends.”

One of the group’s operational digitalisation activities is its SmartCargo initiative. More than 12,000 freight wagons have now been equipped with position, movement and impact sensors, transforming them into intelligent assets capable of real-time monitoring. A further project to integrate weighing sensors is currently underway.

Credit: ÖBB Weixelbaum

Over the past five years, the digital shift has accelerated across the rail freight industry, from train operations through to terminal and tracking capabilities. Real-time freight running information, similar to what passenger services already offer, is now live for operators, while digitised terminals are reaching high levels of automation.

Freightliner, for example, is operating terminals where 98 per cent of vehicle arrivals and departures are automated, cutting turnaround times to under 30 minutes nationally.

“Analysing container throughput and terminal peaks is allowing resource improvements and increasing terminal performance for rail services,” notes Julian Worth, chair of the Chartered Institute of Logistics and Transport (CILT) UK’s Rail Freight Forum.

“The digitisation of rail and terminals is creating the opportunity to further integrate rail into logistics supply chains, attract new volume and deliver rail freight growth targets.”

Meet MIKE

Then there’s its digital logistics platform, MIKE – a great example of how ÖBB RCG is improving service and processes through optimised digital collaboration. MIKE replaces spreadsheets and email exchanges, enabling orders to be processed instantly and tracked through every stage of transport from pickup and delivery through to wagon numbers, load weights and special conditions.

“This reduces the workload for employees, minimises errors and ensures both customers and employees can see the status of shipments at all times,” says Krutzler.

Numerous innovation projects are underway at European level, she adds, highlighting the TRANS4M-R and DACtiVate projects. These, she says, will lay the foundation for the further digitalisation of freight wagons.

“In addition to the mechanical and pneumatic centre buffer coupling, ÖBB RCG's demonstrator train will be equipped with continuous power and data for the first time. Together with the electronic components installed on the wagons and locomotive, this will form the basis for the implementation of the first digital freight train functions, such as wagon recognition, wagon sequencing and automatic brake test.

Credit: ÖBB Weixelbaum

“Another project involves equipping a freight wagon with its own drive and digital components so that it can be tested for semi-automated operation on connecting railways or between connecting railways on the last mile,” she adds.

ÖBB RCG is also pioneering multimodal integration. One of its current flagship projects is in partnership with truck allocation platform developer Transporeon, making it the first rail freight company to integrate rail services into a traditionally road-focused network. This connects rail to thousands of new customers and makes it more accessible for companies without their own sidings.

“Multimodal transport, which combines the sustainability of rail with the flexibility of trucks on the first and last mile, is our best chance for sustainable land transport in Europe,” Krutzler concludes.

Bhavik Patel, president, IQVIA Commercial Solutions

This engine autonomously coordinates and deploys a set of specialist medical AI tools… providing complete and helpful recommendations for individual patient cases.

Dyke Ferber, clinician scientist at the Else Kröner Fresenius Center for Digital Health

Caption. Credit:

Total annual production

Australia could be one of the main beneficiaries of this dramatic increase in demand, where private companies and local governments alike are eager to expand the country’s nascent rare earths production. In 2021, Australia produced the fourth-most rare earths in the world. It’s total annual production of 19,958 tonnes remains significantly less than the mammoth 152,407 tonnes produced by China, but a dramatic improvement over the 1,995 tonnes produced domestically in 2011.

The dominance of China in the rare earths space has also encouraged other countries, notably the US, to look further afield for rare earth deposits to diversify their supply of the increasingly vital minerals. With the US eager to ringfence rare earth production within its allies as part of the Inflation Reduction Act, including potentially allowing the Department of Defense to invest in Australian rare earths, there could be an unexpected windfall for Australian rare earths producers.