Ukraine crisis briefing

Powered by

Download GlobalData’s Ukraine Crisis Executive Briefing report

- ECONOMIC IMPACT -

Latest update: 16 August

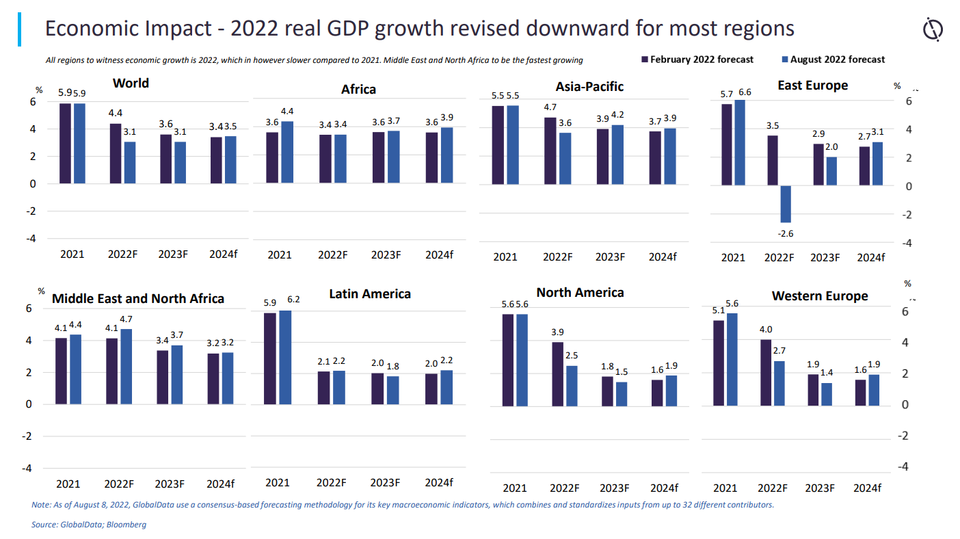

GlobalData forecasts that the world economy will grow at a slower pace of 3.1% in 2022 following a 5.9% growth in 2021. In addition, the global inflation rate is projected to rise to 7.5% in 2022 from 3.5% in the previous year due to supply chain disruption amid the Ukraine-Russia war.

The GCC nations are forecast to grow at their fastest pace in years on higher hydrocarbon prices. Among the six GCC nations, Saudi Arabia is projected to be growing the fastest with real GDP forecast at 7.3% in 2022, followed by Kuwait (6.8%), Oman (5.7%), UAE (5.2%), Qatar (4.4%), and Bahrain (3.3%).

- SECTOR IMPACT: TRAVEL AND TOURISM -

Latest update: 16 August

Revenue impact

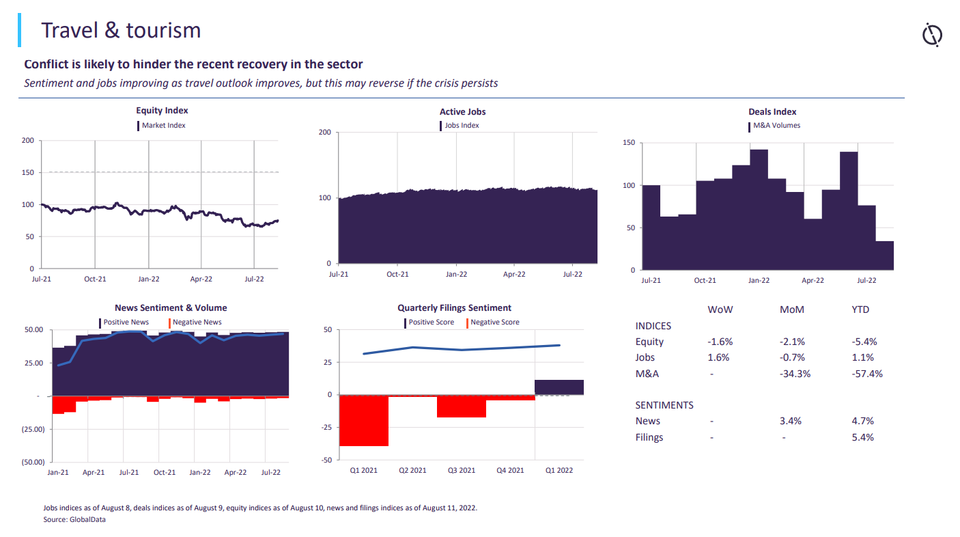

With no end to the conflict in sight, fuel prices will continue to surge for airlines. This will negatively impact their bottom lines, unless they pass the full additional cost on to the traveller, which could reduce demand in an industry where consumers can easily find substitute services.

For example, American Airlines is forecasting fuel costs to increase between $3.92 to $3.97 per gallon, increasing $0.33 per gallon from the previous estimate of $3.59 to $3.64. Increasing fuel costs means that airlines cannot optimise performance and their post-Covid-19 recovery timelines will be extended as a result.

Aeroflot, Russia’s flagship airline, has seen its revenue cut dramatically. It is now planning to raise up to $3bn in an emergency share issue.

Travel enters a new era

Low tourist demand means many cars rental companies have been forced to sell their fleets in order to stay afloat during the Covid-19 pandemic.

Markets in which airport pickup is the largest channel, such as the US, have particularly suffered, but the effect has been felt all over the world.

But as demand picks up, with more people traveling and supply still down, major price hikes are likely to be in store for anyone who wants to rent a car.

Key Travel And Tourism developments

SANCTIONS

In 2022, Thailand is set to fully reopen its borders to international tourists with no need for a negative pre-departure PCR test. Additionally, it has not placed any restrictions on Russia concerning the ongoing geopolitical crisis with Ukraine and has a tourism product that is naturally attractive to Russian travellers. These factors will likely combine to create a stiff year-on-year increase in Russian visitation to Thailand in 2022.

In May 2022, Thailand’s Minister of Commerce stated that Thai banks had displayed interest in Russia’s proposal to introduce the MIR payment system for Russian travellers in Thailand and pledged to coordinate with the appropriate Tourism and Transport ministries to facilitate direct flights from Russia

Luxury cruise company, Tradewind Voyages, which operates the Golden Horizon, has paused operations due to sanctions against Russia. The company has been impacted by sanctions placed on its major lender VTB bank, which has its headquarters based in Russia. This shows that travel and tourism companies may still be heavily impacted by sanctions indirectly, even when they have no physical presence in Russia and Ukraine.

Travel enters a new era

Low tourist demand means many cars rental companies have been forced to sell their fleets in order to stay afloat during the Covid-19 pandemic.

Markets in which airport pickup is the largest channel, such as the US, have particularly suffered, but the effect has been felt all over the world.

But as demand picks up, with more people traveling and supply still down, major price hikes are likely to be in store for anyone who wants to rent a car.